Before COVID-19, Estate Planning was largely looked at as something only for the rich and a reminder of one’s own mortality. However, the onset of the pandemic has changed this.

COVID-19 has given rise to more Estate Planning discussions. It brought about significant changes in its earlier perceptions. Now, people are more aware about the purpose of Estate Planning and the need to create an Estate Plan, despite their financial and familial situations. Moreover, the pandemic has made it necessary to face one’s own mortality and plan for it accordingly to protect their loved ones.

Family conflicts were a leading threat or hindrance to people’s Estate Planning processes before COVID-19 (although family conflicts are still a threat to blended families). However, after 2020, prolonged life expectancy and healthcare costs have taken its place, according to a TD survey.

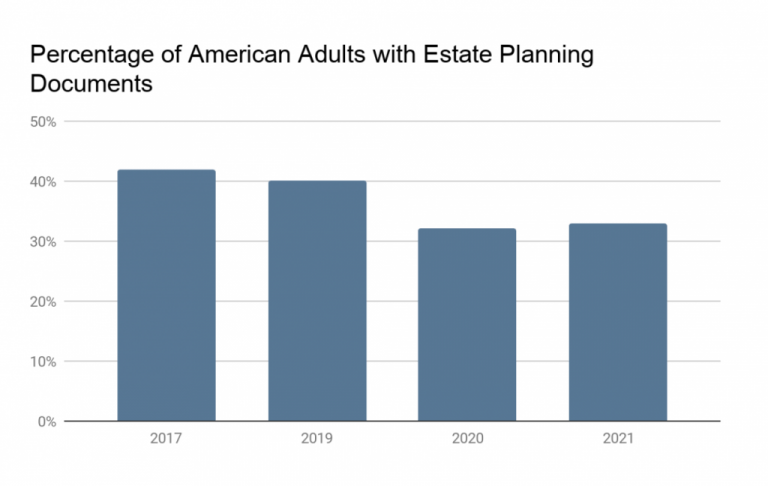

These observations make it seem like the number of people engaging in Estate Planning has been on the rise since COVID-19. However, this is not the case.

People’s Response to Estate Planning During COVID-19

Despite changing perceptions, there has been only a 2.8% rise in the number of people actively participating in creating Estate Plans since 2020, which is still considerably low when compared with the numbers in 2017.

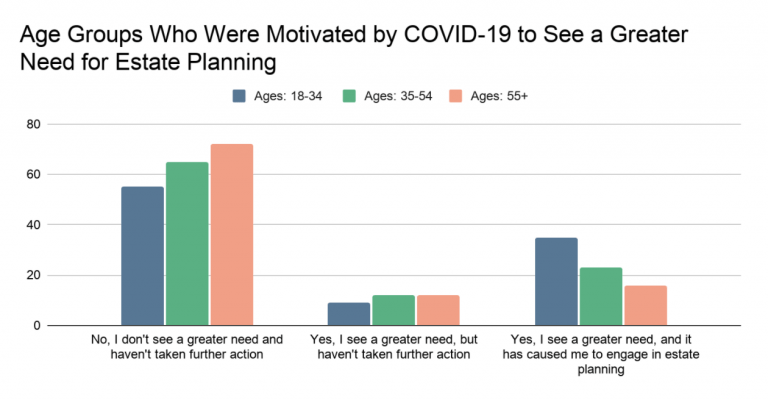

A demographic breakdown of these numbers, however, shows how different age groups are motivated to engage in Estate Planning during COVID. The younger generation, between 18 and 34, is actively pursuing Estate Planning. This includes, considering, planning and executing an Estate Plan.

On the other hand, people over 35 years of age have an almost unchanged reaction to Estate Planning and haven’t taken any actions in their Estate Planning processes.

Estate Planning Administration During COVID-19

While discussions with respect to Estate Planning are slowly increasing, the perception behind them is not entirely positive. The impact of COVID-19 on Estate Planning administration is more or less similar to this.

COVID-19 brought the limitations of Estate Planning to the forefront. Intermittent lockdowns and social distancing made these changes necessary to make Estate Planning more accessible to people.

Electronic signatures, remote witnessing and online notarization, among others, have been introduced to make Estate Planning a pragmatic solution for everyone despite their situations. Client and counsel interactions, too, are happening remotely.

However, the setbacks in Estate Planning administration far outweigh the improvements that COVID-19 gave rise to. This includes multiple court closings, case postponements, tax-filing delays, etc.

Therefore, while creating legally-valid Estate Plans has been made simpler, their effectiveness is delayed.

Things to Remember While Estate Planning During COVID-19

- Review Estate Planning Documents: COVID-19 has changed a lot of things personally and professionally for almost everyone. So, make sure you relook your company’s financial holdings and your Beneficiary Designations regularly.

- Legalize your Estate Planning Documents: Notarizing your documents and signing your documents around witnesses are some ways to give legal authority to your documents.

All these techniques can now be implemented online and legalizing your documents has never been easier. - Take advantage of rapid digitization: There are multiple online tools and platforms to create your own legally-binding forms and documents, like Wills and Powers-of-Attorney, to plan your Estate.

- Add Digital Assets to your plan: Digitization has been on the rise since COVID-19. Adding Digital Assets to your Estate Plan is an easy way to secure and pass on your rapidly growing digital footprint to your Beneficiaries.

- Create an In-Case of Emergency Plan: COVID has made it evident that you and your loved ones need to be prepared for any emergencies. Creating an Emergency Plan with a Healthcare Proxy, and Last Will and Testament is the most effective and legal way to do this.