The future of the internet as we know is Web 3.0. In the early days of the internet (1991-2004), Web 1.0 had static pages hyperlinked together which mainly functioned as tools to provide knowledge. These pages did not have any login requirements or advertisements. It was just like a big encyclopedia available digitally!

From 2004 till now, we have Web 2.0 which is basically focused on marketing. Websites or digital platforms tend to collect our data (based on our search and interests). For instance, you might have noticed that whenever you search for anything let’s say, laptops, you start getting ads related to laptops on apps and platforms (other than the platform you have used for searching).

Web 2.0 Vs Web 3.0

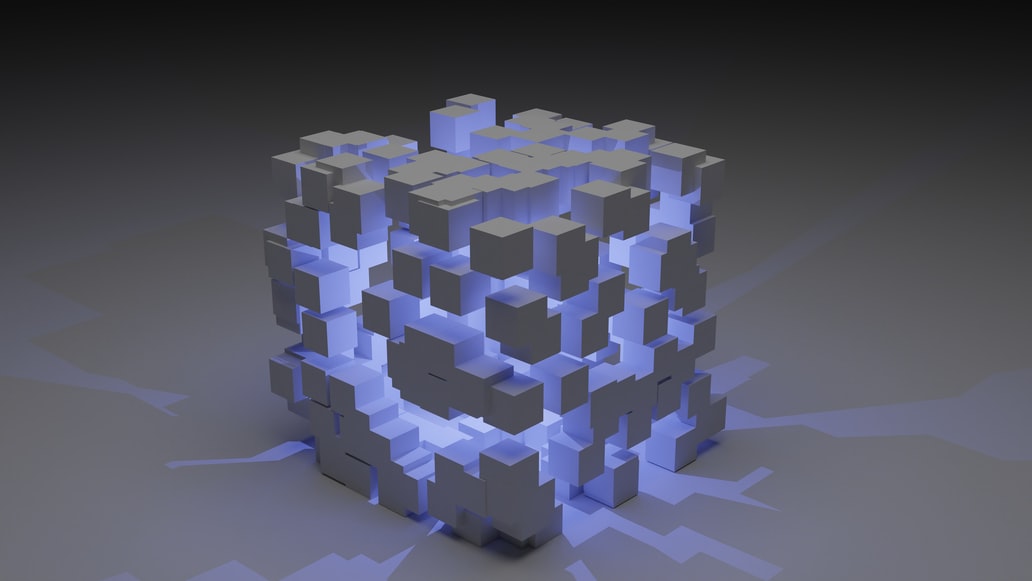

Web 2.0 can be regarded as the generation of data privacy invasion. Web 3.0 is a concept that demands the next generation to have decentralized applications or dApps. It will be a new way to build applications that can be accessed all over the world through a decentralized database instead of a centralized one which leaves room for error if it goes down or similar situations occur that can harm access to data.

For instance, if you have to make transactions with a payment app, a bank account is required. To open a bank account, you need to submit your personal information. This information is stored in the bank’s Centralized server. If the server crashes or gets hacked then all the confidential information shared by you gets in the wrong hands!

On the other hand, Decentralized platforms and users connect directly without any third-party giant (which could inherently store users’ data). For instance, Decentralized Cryptocurrency Exchanges or DEXs like UniSwap, PancakeSwap allow users to directly interact with each other’s wallets without any intermediary. The information of a person’s wallet remains confidential (Non-Custodial Wallets) unlike Custodial wallets (which are handled by Centralized Cryptocurrency Exchanges) which pose the threat of data and identity theft if the Cryptocurrency Exchange gets hacked!

There are chances of several DAO (Decentralized Autonomous Organization) popping up which would subsequently act as a strong opponent against Centralized corporations. Since the concept of Web 3.0 promises data privacy, the digital identity of users would no more be connected to their real-world identity.

You might also be interested in reading:

This makes it impossible to steal a person’s identity, or even make a person go entirely broke in a day because their bank account crashed or someone managed to shut down the server running your bank account balance into nothingness. Web 3.0 allows people to be the owners of their data as compared to Web 2.0 where users are regarded as products.

Web 3.0 and NFTs

With the advent of Cryptocurrencies and the blockchain, Web 3.0 could bring immense value to both buyers and sellers. The selling point of NFTs and tokens isn’t limited to just Web 3.0 itself – it’s also applicable to every market where goods and services can be bought with Cryptocurrency.

This idea of blockchain was implemented in 2017 when Ethereum came out with the first useable Cryptocurrency called Ether (ETH). Smart Contracts were developed which is basically an agreement between two parties that can be customized using certain features in order for them to achieve whatever goal they are trying to achieve through it such as sending funds from one place to another and having that transaction recorded in an unchangeable manner where neither party can change it once agreed upon with.

Today, NFTs (especially NFT Art) represent how Ownership and trading could be handled in the future. When you understand every aspect of NFT, and what the concept offers then it becomes clear that a distributed database wrapped along with Smart Contracts could pave way for a new financial system.

Cryptocurrency, NFTs and everything that Web 3.0 and Blockchain Technology can offer in the near future has the potential to change many parts of the world’s financial systems. In order to take full advantage of the opportunities presented by cryptocurrencies, users must be prepared for potential roadblocks along the way. A Digital Estate Plan can help ensure that your digital assets are handled in a manner that you see fit when they may no longer be available to you.